From the Peter Peterson Foundation

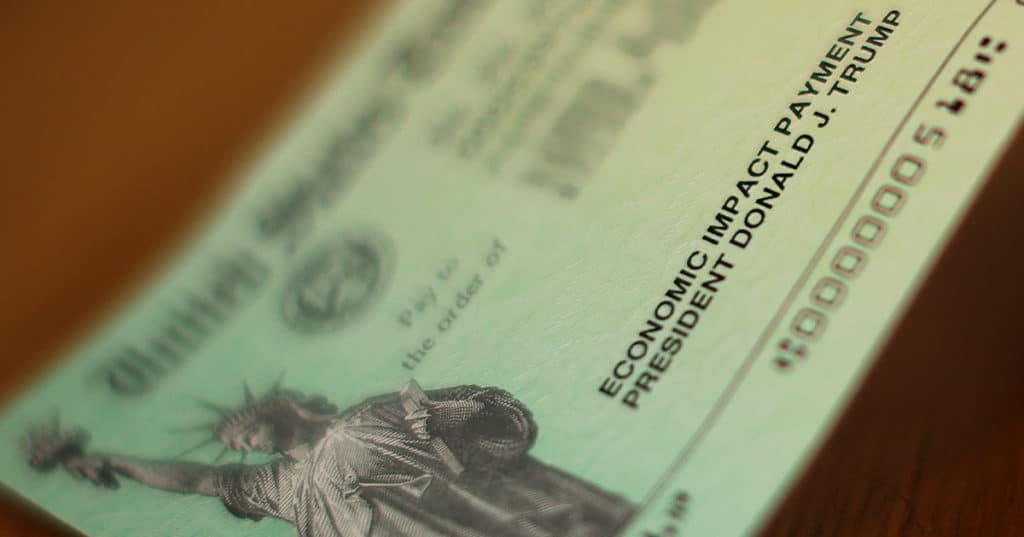

On December 27, 2020, the federal government enacted a relief package that included a second round of Economic Impact Payments (often referred to as “stimulus payments”) to Americans. Eligible individuals will receive a payment of $600, or $1,200 for married individuals, plus $600 for each qualifying child. However, those payments gradually phase out for incomes above $75,000 for single taxpayers, $112,500 for taxpayers filing as head of household, and $150,000 for married couples filing jointly. Taxpayers would be ineligible for any payment, unless they have a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

The Internal Revenue Service (IRS) and the Treasury Department began issuing such payments on December 29; most recipients will receive those funds by direct deposit. Paper checks and debit cards also began going out and will continue to be sent through January. For Social Security and other beneficiaries who received the first round of payments via debit card, they will receive this second payment the same way. As of January 4, about $112 billion of the second round of payments have been sent out; overall, such payments are expected to cost a total of $166 billion according to the Committee for a Responsible Federal Budget.

Visit PGPF.org for more information.