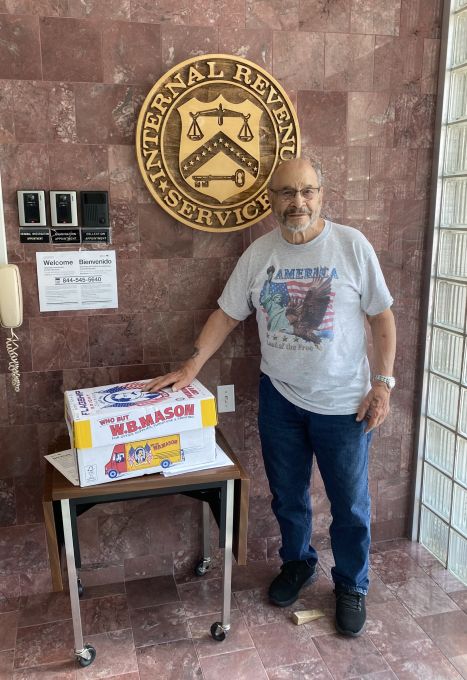

Tony Futia at an IRS hearing in New Windsor with a box of 500 pages of documents

By Dan Murphy

With President Donald Trump suggesting that the federal income tax be abolished or his recent comments that the income tax should be eliminated for anyone earning less than $150,000, we wanted to reach out to North White Plains resident Tony Futia.

Futia has been involved in a five-year legal battle with the IRS in Federal Court. Since 2014, he has refused to pay his Federal income tax because he believes it is voluntary.

Futia argues that the 16th Amendment to the US Constitution, which reads, “The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration,” does not require all Americans to pay a Federal Income tax. Only Federal employees are required to pay an income tax, claims Futia, and no law says every other American has to pay a Federal income tax.

“The government has a lot to lose if forced to replace the individual income tax with, say, a consumption tax, so it relies on fear and intimidation of the people. For now, they are trying to destroy me financially. The next step would be to destroy me physically, but it is too late; the cat is out of the bag, and all of the information of fraud and corruption is in the hands of the elected sheriffs of New York state and online at https://wethepeopleofny.org/wtp-of-ny-news/what-would-life-in-america-be-like-without-a-constitution/

After receiving an unfavorable decision from a Federal Court Judge in 2022, Futia appealed his case to the US Supreme Court. In November of last year, the USSC denied his application to hear his case without argument or reason, as is the norm for thousands of other cases the justices refuse to hear.

Originally, this case was assigned to Judge Kenneth Karas, and almost immediately transferred to Judge Vincent Briccetti who Futia says “prevented/did not require defendant United States government to produce or show a law that required me to pay a personal federal income tax by calling my questions frivolous and not responding at all to my many request for a jury trial.”

Futia currently has a lawsuit pending against NYS Comptroller Tom DiNapoli for processing a lien against Futia from the IRS for $96,565 in unpaid taxes. “The Comptroller signed off, and they took money out of my trust fund. As a State Employee, they should have waited until after I received my retirement funds. But they took 84% of my retirement to pay my 2014 and 2017 taxes. They should have only taken 15%, which is the maximum they can take. But the Comptroller violated the law when he approved the withdrawal of funds, and hopefully, this case will give me a chance to make my arguments about the federal income tax,” said Futia.

Futia’s other argument is that when taxpayers fill out and sign a W-4 form, they voluntarily agree to pay a Federal Income tax. “They can’t show me the law that requires all Americans to pay an income tax because one does not exist. And that is my argument, which I want to be heard by a jury of my peers. “

We have two classes of citizens in this country: State Citizens (Capital C Citizens) and federal citizens (lowercase C citizens). Before the Civil War, there was only one class of citizens under American law. State Citizens are governed and protected by state constitutions. Unless State Citizens volunteer by signing a W-4, they are not liable or required to pay a personal federal income tax.

Federal citizens living within a federal possession such as Washington DC, Puerto Rico, etc., or living within one of the 50 states working for the federal government, subjecting them to the federal government employee tax act, are not protected by the tax clauses of the sovereign 50 states and are required to pay a federal personal income tax.

“The Government cannot afford to lose this case because our Federal government is already $32 Trillion in debt. They need the money they take in from the illegal income tax. Martha Stewart, Pete Rose, and Joe Louis are some of the more famous Americans that the IRS went after. I’m just a regular Navy Veteran who is taking a stand against tyranny. We should not be afraid of our government.”

The other question we have asked Futia over the years, how will the government pay its bills without an income tax, is being answered by the President—through tariffs.

“The ball is now in President Trump’s court. I gave him all the information, including the 538 questions to be answered by the government, which they refused to answer, conclusively showing no law. And I think the President knows it.”

A victory tax was used to finance World War II, which expired at the war’s end.

When the victory tax expired, the federal government fraudulently imposed an income tax on security, paying off the private banks(Federal Reserve).

Congress and the courts are aware of this fraudulent cover-up, and now that President Trump is aware of it, let’s see how he handles it. It will be very interesting to see how this fraud gets resolved, and Trump is capable of resolving this mess.

Futia appeared at two hearings before the IRS, both last year. He has not heard back from the IRS after those hearings, but he has still not paid his Federal Income tax for 10 years.

Futia agrees with President Trump on Tariffs. “Before there was an income tax (pre-1913), we paid for our government through Tariffs. And we can do it again.”

Four more questions for Futia:

1-What about Trump’s new income tax plan, to eliminate it for those earning less than $150,000 per year? “I think that’s Trump’s way of easing into it, first by eliminating it for those under $150k, and then later he can abolish it altogether.”

2-Can Trump eliminate the Income Tax alone, or does he need Congressional approval? “He can do it on his own. This is an illegal tax; it violates the Constitution.”

3-The way around Futia’s argument is for Congress to pass a law enacting a Federal Income Tax. Are you concerned that they will do that? “Not at all; Congress would never approve an income tax and then return to the voters. They would throw them out of office.”

“President Trump has also called for no tax on tips or social security benefits. He is going in the other direction, and the American people love him for it.”

4-Some media coverage of Trump’s plan claims that citizens will still pay a withholding tax on their income and paychecks even if he eliminates the income tax. Is that true?

“No, not if the employee refuses to complete a W-4T form, which they are entitled to do. I did it late in my career working for the Town of North Castle. This is another scam by the government. Withholding your taxes is how the government uses your money until it is due. The best way for people is to put aside the money they will owe in taxes in a savings account and earn a few dollars. That’s what the government is doing if you fill out a W9.

Futia states, “The following New Yorkers are not required to pay a personal income tax. All New York State police officials and officers; All New York State village, town, city, county, and state employees, and most Citizen residents of New York State.

“I received a 50-year retirement benefit from New York state, based on 45 years of employment with the town of North Castle, with two years credit for being a member of tier 1 retirement system and three years credit for my service in the United States Navy submarine service.

“The New York State Comptroller will not show me the law that requires and makes me liable for the tax. That is because no law says most Americans must pay a Federal income tax. I have submitted to the Greene County Sheriff documents and video exhibits of IRS fraud and corruption for safekeeping and investigation in case of my death and for possible charges filed with his department against the state comptroller.

Futia’s organization, We The People of New York, Inc. (website: wethepeopleny.org), has a wealth of information on this topic online. Twenty years ago, We the People held hearings in Washington, D.C., on this topic and advertised in USA TODAY. One of the most interesting videos is https://www.youtube.com/watch?v=gpeo6FZgdD0.

In this two-hour video of a hearing in Washington, we most enjoyed the testimony from Victoria Osborne, a forensic accountant. When asked if it was legal for the IRS to place levies on Social Security benefits for non-payment of income taxes, Osborne said, “This is a direct violation of Title 42 Section 407. When I confronted the IRS, they would immediately stop the levy.” Osborne also said the IRS illegally exceeds a 15% levy restriction on a taxpayer’s income. “The law restricts the IRS to take only 15%.”