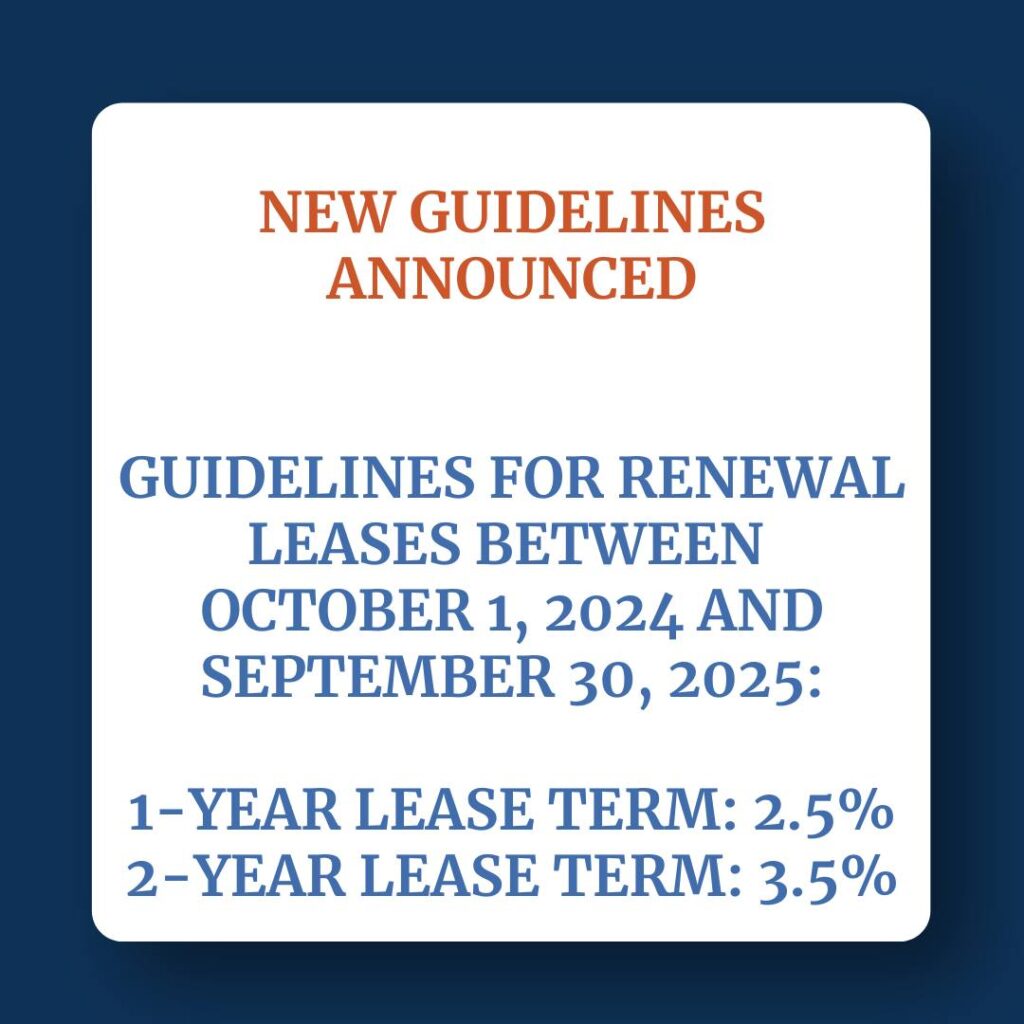

On June 27, the Westchester County Rent Guidelines Board approved a rent adjustment of 2.5% for one-year leases and 3.5% for two-year leases starting October 1, 2024 through September 30, 2025, with a final vote of 6-1.

While the new increases will prevent the destructive and counter-productive rent freeze that tenant advocates had been seeking, they do not match the escalating operating expenses of rent-stabilized buildings. These costs have surged due to inflation, rising material costs, and soaring insurance rates over the past year.

“Once again, property owners are given disappointing rent increases. We have the oldest stock of housing which has the highest need for maintenance and repairs. It is becoming increasingly difficult, if not impossible, to provide safe and well-maintained units. The Rent Guidelines Board has become our only avenue for these necessary increases but year after year, these increases don’t even keep up with inflation or the Consumer Price Index (CPI). The board is completely skewed towards the tenants, without anyone taking into consideration the documented facts provided. The system is clearly broken and I fear it won’t get fixed until a catastrophic event occurs,” Lisa DeRosa, President of the Building and Realty Institute (BRI) and White Plains property owner said.

With an average rent $1,473 per month across all sizes of rent-stabilized apartments, this would be an average increase of up to $X per month beginning for leases beginning on or after October 1, 2024.

This year, the major points of discussion have been the soaring insurance premiums and the ongoing devaluation of rent-stabilized properties, in addition to inflation and rising maintenance costs for property owners. These have contributed to the number of rent-stabilized units being taken off the market entirely since 2019 – nearly 5,000 according to statistics presented to the board by the Division of Housing and Community Renewal.

Insurance premiums have been escalating by an average of 26% annually, while coverage is diminishing or challenging to secure. The average cost to insure an affordable apartment has surged to $1,770, marking a 103% increase from four years ago when the average annual premium per unit was $869. A decrease in insurers willing to provide coverage for multifamily housing, especially rent-stabilized buildings, has made it increasingly challenging for property owners.

The aftermath of HSTPA in 2019 has led financial lenders to reassess the viability of granting loans to rent-stabilized properties due to the new regulations and years of subpar rent increases. Valuations of the limited multifamily property sales have dropped, impacting loans and posing risks to financial institutions like Signature Bank and New York Community Bank. Reports indicate that two-thirds of rent-stabilized buildings in NYC are at risk of selling for less than their previous sales price, with a significant portion losing market value since 2018.

The diminishing property values have restricted property owners’ access to loans for essential upkeep, renovations, and maintenance, leading to a rapid deterioration of rent-stabilized buildings in the coming years.

“Every morning, I wake up wondering: How many more years can I afford to keep my building in business when I’m faced with abysmally low rent guideline increases and my maintenance and repair costs continue to rise? What’s going to happen when it’s time for me to refinance my mortgage in a year and I find that no bank wants to come near my building because it’s already viewed as a negative investment?” Alana Ciuffetelli, Chair of BRI’s Apartment Owners Advisory Council said during her testimony. “It’s challenging to remain positive as a rent-stabilized property owner in these times, and these rent guideline increases offer a small glimmer of hope amidst the uncertainty.”

Amid increasing operating expenses, the Housing Stability and Tenant Protection Act (HSTPA) of 2019 imposed significant limitations on programs for funding building upgrades and renovations, underscoring the importance of annual increases by the Rent Guidelines Board.

Despite the recent change in legislation which raised the Individual Apartment Improvement (IAI) cap to $30,000, this amount falls short for comprehensive apartment rehabilitation after a long-term tenant leaves. Renovation costs typically range from $100,000 to $150,000, especially for extensive repairs.

A recent survey by BRI revealed that most landlords have refrained from applying for Major Capital Improvements (MCI), which include essential upgrades like boiler replacements, window installations, electrical rewiring, plumbing, and roofing. Landlords delaying major renovations are waiting for a more favorable economic climate to avoid unforeseen setbacks. According to a study by Hudson Valley Patterns for Progress, MCI applications have declined by 83% in the last five years. Furthermore, rent guideline board increases have consistently lagged behind inflation, with this disparity intensifying over the past four years.

The Westchester Rent Guidelines Board announced that it will be scheduling a further public meeting to be held in September 2024 (specific date to be determined) to certify the rent guidelines for rent-stabilized leases commencing between October 1, 2024 and September 30, 2025. This formality will not change the percentage rent increases voted upon tonight.