Sales Tax Increase Still on Hold; Playland -Standard Deal Dead

By Dan Murphy

New York State has recently made changes to one of the most popular tax relief/rebate programs, the STAR school tax reduction program. Created under former Gov. George Pataki in 1997, the STAR program was a direct result of property owners in Westchester and Putnam counties – and in Nassau and Suffolk counties on Long Island – getting taxed out of being able to afford to live in their homes by property taxes.

And with two-thirds of your property tax bill coming in the form of school taxes, the STAR Rebate program used to provide direct reductions in homeowners’ property tax bills by lowering their school taxes. Recently, NYS has change the way in which STAR will be distributed.

For Westchester homeowners with incomes of less than $250,000 per year, there will only be a change in the way you see the tax reduction. Greenburgh Town Supervisor Paul Feiner has, once again, explained the changes and why he opposes them, in a recent email to his constituents:

“Don’t get stressed if you get a letter from NYS advising that you will not get STAR Program Reduction out of school tax bill (why I don’t like the new law).”

“Almost 2,500 residents of Greenburgh will be receiving a letter from New York State this week advising them that they will no longer receive the STAR program reduction of their school tax. I don’t know why New York State changed the law but do predict that the letters will cause some people to worry. That’s why I’m writing this note. I don’t want you to get very upset. The ramifications to taxpayers probably won’t be that bad.

“NYS changed the law. Homeowners with incomes greater than $250,000 and less than or equal to $500,000 will no longer receive the STAR program reduction off their school tax bill. Instead they will automatically be enrolled at the state level and will receive a check for the STAR credit. The amount will be worth at least as much as the tax savings they received when it was taken off the tax bill. A letter will be sent to impacted taxpayers from NYS that fit the criteria. The letter will also be the confirmation that the state registered the owner in the new check-based program. There is nothing else the owner has to do.

“The new change in the NYS law could affect the owner’s escrow accounts. If the owner wants to appeal the state’s decision, then they should follow the instructions on the state-issued letter. Any and all questions regarding the STAR changes should be directed to the NYS Department of Taxation and Finance at 518-457-2036.

“I am not pleased with the new law for the following reasons: 1.) Residents are going to be stressed over the change, and will have to write a larger tax check to the town in September and January when they pay the school taxes – creating unnecessary bad will against schools. The school portion of your tax bills is the largest tax you pay the town – close to or over half your tax bill. The town acts as a tax collector but the schools are independent of the town.

“2.) I assume there are more administrative costs (postage and mailings, processing checks).

“3.) I don’t trust the postal service – they send mail to the wrong addresses very frequently (I receive hundreds and hundreds of complaints about the postal service each year). I worry that some of the checks will be lost in the mail. If that happens, feel free to reach out to me and I will follow up.” (End of Feiner email).

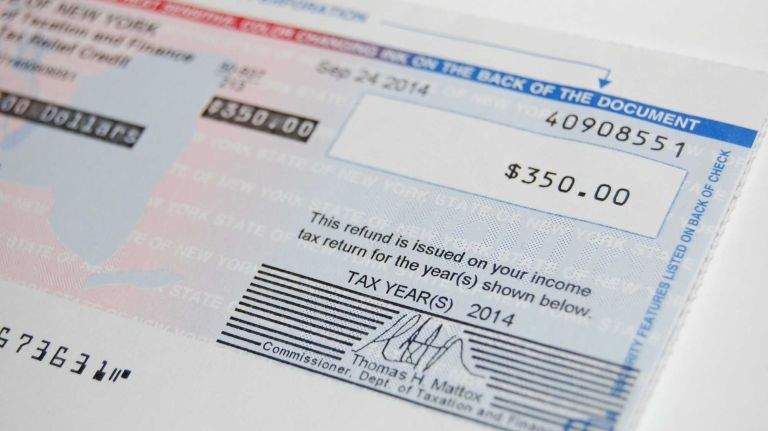

The major change in the $3 billion program is that instead of a direct payment, or tax credit to homeowners, checks will now be mailed out in the fall. About 2.6 million New York homeowners currently get a STAR rebate, with rebates averaging $800 per year statewide, and higher rebates in Westchester; 343,000 of those STAR benefits came in the form of a check.

The basic part of STAR remains the same. If you own a primary home in New York and your income is less than $500,000, you are eligible for STAR. Senior homeowners, with one or both spouses age 65, can get an Enhanced STAR rebate if they have income of less than $86,300. That average senior enhanced STAR rebate is $1,400.

New homeowners already get their STAR rebate by check, and now, under the new rules, anyone earning between $250,000 and $500,000 a year will get a check for their STAR rebates rather than receiving the savings directly in their school tax bills. Those of us who earn less than $250,000 and bought our homes before 2015 will still get the STAR rebate directly off our tax bills.

New York State wants all homeowners to move to getting their STAR rebates by check because, from a state income tax analysis, the checks are a “personal income tax credit” and not a state expenditure of sending more money to school districts.

“The goal of these changes is to move people to the credit program, which is more efficiently administered and gives the state a better look at who is receiving the benefit to help prevent abuse of the system,” said Freeman Klopott, a spokesman for the state Budget Division.

The state is also incentivizing homeowners to move to a check instead of a direct rebate-reduction on your tax bill by providing a 2 percent STAR benefit increase only to those who receive a rebate check. Any Westchester homeowner can switch to a check and get the 2 percent increased benefit online at www.tax.ny.gov/star.

There are a number of other concerns New Yorkers have about getting their STAR reimbursement via a check: If your check doesn’t arrive before your school taxes are due, you have to lay out the money, and the fear is that some homeowners don’t have the money to lay that out. Also, if you pay your taxes with your mortgage through escrow, you will end up paying the full amount of school taxes and then get the STAR check in the mail.

The STAR rebate is not to be confused with the property tax relief credit, which is mailed out every year to homeowners who have incomes of less than $275,000 per year and whose school district and local government budgeted themselves below the state-mandated property tax cap.

The property tax relief credit is set to expire in 2020 and would have to be extended by Gov. Andrew Cuomo and the State Legislature. Average tax relief credits total $500, or up to 60 percent of your STAR benefit.

In two other tax-related issues for Westchester, the planned 1 percent sales tax increase for Westchester has still not been passed, with legislators and the governor set to break for the summer in two weeks. County Executive George Latimer has asked the state to increase the sales tax countywide, except in the cities of Yonkers, New Rochelle, Mt. Vernon and White Plains, where the sales tax is already 1 percent higher. In exchange, Latimer has vowed not to increase county property taxes for two years.

At Playland, the county-owned amusement park, any hopes for a compromise between county government and the private company who wanted to run Playland, Standard Amusements, appear dead for good.

Standard Amusements recently filed for Bankruptcy because, without the Playland deal, it has no revenue or future revenues. And Latimer’s recent comments point to a point of no return between the two sides, after public comments by Standard Amusements about health and safety violations at the park went a little too far.

The one Playland-related issue for Westchester taxpayers will be: How are the needed $100 million in capital improvements at the park paid for? If they can be bonded and paid for through revenues at the park, all the better. But if Westchester homeowners have to pay a 1 percent county tax increase every year to pay for improvements at Playland, regardless of whether they ever go to the park, that could be a concern.