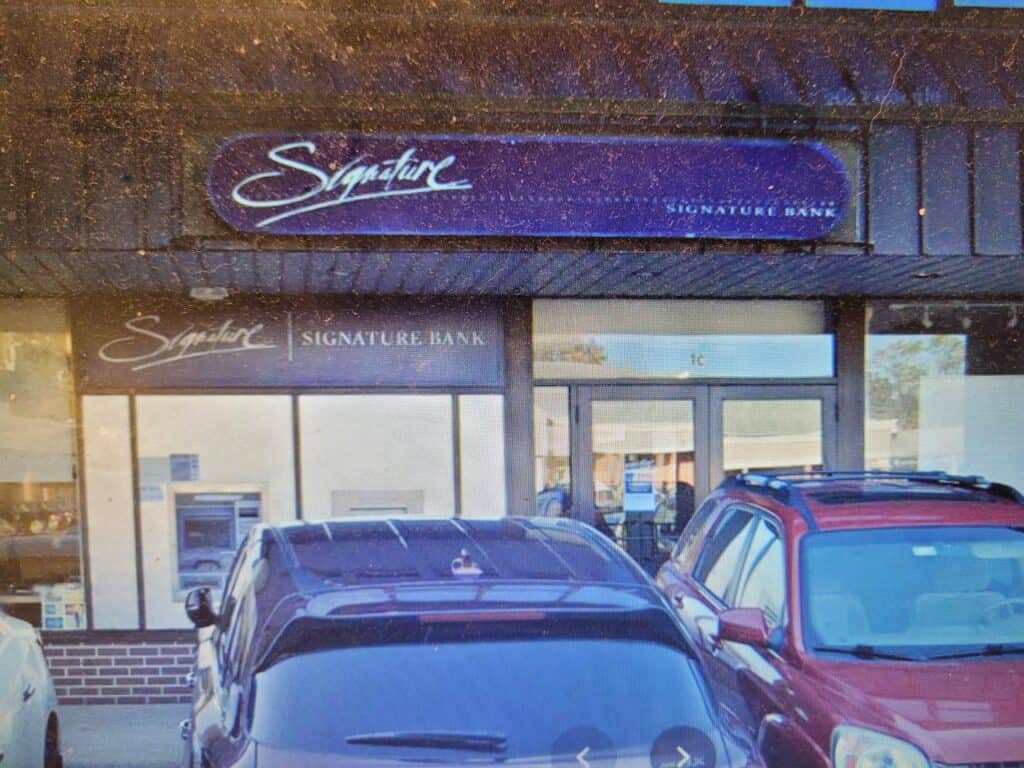

Depositors at Signature Bank brach in New Rochelle were seeking answersBy Dan Murphy

The bank failure of Silicon Valley Bank, SVB, in California over the weekend, overshadowed another bank failure in New York, by Signature Bank, which has two branches in Westchester; one in New Rochelle and another in White Plains.

Governor Kathy Hochul explained that the State Department of Financial Services took over the operations of Signature Bank and then turned it over to the FDIC. “Throughout the weekend, DFS Superintendent Adrienne Harris and I have been working closely with Federal partners on ways to stabilize the banking sector and protect the hard-earned money of New Yorkers whose livelihoods depend on impacted companies.”

“I’m grateful that the Federal regulators have taken steps to do just that, and I hope that these actions will provide increased confidence in the stability of our banking system. Many depositors at these banks are small businesses, including those driving the innovation economy, and their success is key to New York’s robust economy.”

“So where do we stand? The New York State Department of Financial Services took possession of a New York Chartered bank known as Signature, and it’s immediately turned over to the FDIC, the department appointed the FDIC to run the day-to-day operations, and this all is in the aftermath of what happened.

“We saw on Friday this unfolding with Silicon Valley Bank out in California, and this had an effect on a bank here, in particular, Signature Bank So, what the Federal Reserve and the FDIC did this weekend was important. They invoke powers that were conferred to them to create a stop gap situation to give out the message to all depositors that their deposits, even above the $250,000 limit, which is in the law with FDIC protections, that those above that would also be protected. And what this did sent a ripple across the states – and also the country – that deposits would be protected, and that was important for people to hear,” said Hochul.

President Joe Biden said on March 13 that the American banking system is safe and secure and that all deposits will be protected and refunded to account holders, even if that amount exceeds the $250,000 limit protected by the FDIC.

SVB had many depositors who had accounts exceeding $250,000, including many California tech companies, like Roku, who had $500 Million in their account.