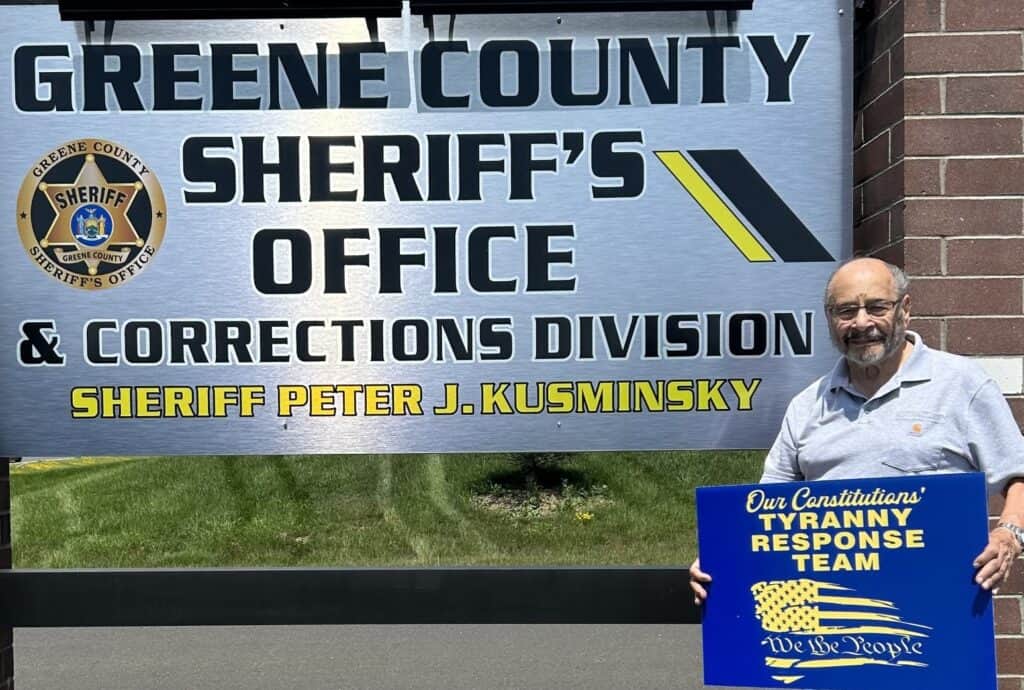

Tony Futia, outside the Greene County Sheriff’s Office upstate

By Dan Murphy

Fighting the Federal Government, and the IRS, is no easy task. Westchester resident Tony Futia is learning this as he attempts to get his day in court on his claim that there is no law that requires most Americans to pay a Federal Income Tax.

“Any law requiring a person to sign and file a tax return would violate that person’s 5th Amendment right not to be a witness against himself and his 5th and 14th Amendment right to due process. That’s why the IRS declares the filing of a tax return to be voluntary,” argues Futia.

Futia, who has not paid his income tax since 2014, became more public about his views that the Federal income tax is voluntary in our newspapers and online at Yonkerstimes.com last year. Since then, several notices of liens have been placed on his social security, pension and bank accounts, by the Westchester County Clerk and the NYS Comptroller’s office.

The notices of liens were filed by IRS agents, but as Futia points out “a notice of lien is not a lien. You have to have a court order signed by a Judge to file a lien, and for that to happen, there has to be a court hearing and argument. The individual taxpayer is entitled to question the charges after which a court order from a judge is required. None of this took place and there is no lien filed against me in the White Plains federal courthouse as required. You can’t take my bank accounts and pension just with a notice of lien. People are not aware of this and we should not be afraid of our own government,” said Futia,

Futia has two cases proceeding in Federal Court. One is a case of first impression, or a case that has not yet been ruled on. Futia is basing the right to be heard on the last 10 words of the First Amendment in the Bill of Rights, “and to petition the government for a redress of grievances.”

“The second case was filed in State Supreme Court against everyone that had anything to do with the illegal liens filed against me,” said Futia. Named defendants include Westchester County Clerk Tim Idoni, Chase bank, Greene County bank, the commissioner of Social Security, and the two IRS agents who filed the liens. That case has been transferred to Federal Court.

In a letter to NYS Comptroller Tom DiNapoli, Futia writes, “I was not liable to pay a federal tax on the money earned from my labor. Therefore, the IRS’s Notice of Levy has no basis in law — Section 6331 of Title 26 of the United States Code does not apply to me. Thus, it would be illegal for you to comply with the IRS’s “Levy” and demand for payment.

“By compelling payment of a tax which is not mandated by law and thus voluntary, NYS Comptroller Tom DiNapoli is cooperating with the IRS by reducing my retirement pension by 84%, to a level that cannot support my life, much less my ability to continue my legal battles in support of the people’s Constitution and against violations of the IRS code.”

“Until the federal government provides a meaningful response to my proper 1st Amendment Petition for Redress of the federal government’s violation of the Constitution’s tax clauses, or until I have exhausted my judicial remedies in the current court case, it would be completely unjust, partisan and biased for the New York State Comptroller to assist the federal government by giving them my retirement pay, thus pauperizing me, making it impossible for me to fairly continue my effort to so hold the federal government accountable to the rule of law,” writes Futia.

We asked Futia what is relevant about the fact that the NYS Comptroller has now placed a lien on his pension, he said, “This is now about all New York State retirees, including teachers, police and fire fighters. The comptroller’s office treats New York State retirees as if they were “subjects” whose. retirement income really belongs to the government not the individual.

“I received a 50-year retirement benefit from New York state, based on 45 years of employment with the town of North Castle, with two years credit for being a member of tier 1 retirement system and three years credit for my service in the United States Navy submarine service.

“The New York State Comptroller will not show me the law that requires and makes me libel for the tax. That is because there is no law that says most Americans have to pay a Federal income tax. I have submitted to the Greene County Sheriff documents and video exhibits of IRS fraud and corruption for safekeeping and investigation, in case of my death, and for possible charges filed with his department against the state comptroller.

“The government has a lot to lose if forced to replace the individual income tax with, say, a consumption tax so it relies on fear and intimidation of the people. For now, they are trying to destroy me financially. The next step would be to destroy me physically but it is too late, the cat is out of the bag and all of the information of fraud and corruption is in the hands of the elected sheriffs of New York state and on-line at https://wethepeopleofny.org/wtp-of-ny-news/what-would-life-in-america-be-like-without-a-constitution/

“The following New Yorkers are not required to pay a personal income tax. All New, York, State, police officials, and officers; All New York State village, town, city, county, state and special district employees, and most Citizen residents of New York State.

“If New York State still has a valid state and federal constitution, bill of rights and government of by and for the people, all of the above should write a short letter of request to the governor and state comptroller to show the law that requires them to file a federal tax return,” said Futia.

The other oddity about Futia’s case is that the IRS is not abiding by the 15% limit placed on pension income that can be placed on a citizen’s income. And, Social Security benefits are not supposed to be allowed to be used to satisfy a lien.

“Because I am 87 years old the IRS is illegally trying to recover all that they claim I owe them ($90,000) within one year in case I die. How thoughtful of them.”

Futia’s organization, We The People of New York, Inc. (website: wethepeopleny.org), has a wealth of information on this topic on-line. Twenty years ago, We the People were holding hearings in Washington DC on this topic and advertising in USA TODAY. One of the most interesting videos is https://www.youtube.com/watch?v=gpeo6FZgdD0.

In this two-hour video of a hearing in Washington, we most enjoyed the testimony from Victoria Osborne, a forensic accountant. When asked if it was legal for the IRS to place levies on Social Security benefits for non-payment of income taxes, Osborne said, “this is a direct violation of title 42 section 407. When I confronted the IRS, they would immediately stop the levy.” Osborne also said that the IRS illegally exceeds a 15% levy restriction on a taxpayer’s income. “The law restricts the IRS to take only 15%.”

Futia’s legal argument, which he hopes to be heard before a jury of his peers in White Plains Federal Court, is that “before World War II, only Federal employees had to pay a Federal Income Tax. The government needed more money to fund the war, so they called it a Victory Tax that all citizens had to pay through an income tax. The victory tax was a temporary tax that expired, and after that, American citizens in the 50 states who are not federal employees do not have to file or pay federal income tax.

When you sign your W-4 statement, you are voluntarily agreeing to pay. They can’t show me the law that requires all Americans to pay an income tax, because one does not exist. And that is my argument, which I want to be heard by a jury of my peers. “

So far, two Federal Judges in White Plains have been assigned to Futia’s case; Judge Kenneth Karas, appointed by President Bush, and Judge Vincent Briccetti, appointed by President Obama. “Judge Briccetti, in my opinion, improperly removed the case in state court to federal court and I now have a legal jurisdictional action against Judge Briccetti,” said Futia.

One question we asked Futia and We the People is, how would we fund our government without an income tax paid by all? “Most education costs are paid for by property taxes. Our roads and bridges are paid for by gas and property taxes, and most of the federal government is not funded by our income tax. In fact, we are borrowing Trillions to operate the federal government, so many of the programs that you may enjoy are being paid for by future generations through the Federal debt. The federal income tax revenues collected only pay for Federal employee benefits and pensions and for payments on the federal debt. If needed, the revenue from the income tax can be replaced by revenue from a new consumption tax,” said Futia.

We have two classes of citizens in this country. State Citizens, (Capital C Citizens) and federal citizens. (lower case c citizens). Prior to the Civil War there was only one class of citizen under American law. State Citizens are governed and protected by state constitutions. Unless State Citizens volunteer by signing a W-4, they are not liable or required to pay a personal federal income tax.

Federal citizens, living within a federal possession such as Washington DC, Puerto Rico etc or living within one of the 50 states working for the federal government subjecting them, to the federal government employee tax act, are not protected by the tax clauses of the sovereign 50 states and are required to pay a federal personal income tax.

“The Government cannot afford to lose this case, because our Federal government is already $32 Trillion in debt. They need the money they take in from the illegal income tax. Martha Stewart, Pete Rose, and Joe Louis are some of the more famous Americans that the IRS went after. I’m just a regular Navy Veteran who is taking a stand against tyranny. We should not be afraid of our own government.”

“The state comptroller will be sued if he allows the IRS to take any funds from my retirement fund.”

Anyone who wishes to contact Mr. Futia can email dmurphy@risingmediagroup.com.