By Dan Murphy

We asked Westchester resident Tony Futia for an update regarding his Federal lawsuit against the IRS. Futia refuses to pay his Federal Income Tax, on the grounds that it is voluntary tax, except for Federal employees and for citizens who complete and W-4 form. “This has been a difficult and at sometimes, very discouraging journey. For many years I have answered every correspondence from the IRS and explain to them why I’m not required to pay federal income taxes. I am never told my arguments and facts are wrong. I am always told they need more time to review my request and get back to me with a response but they never respond. They refuse to show me any law approved by Congress. They refuse to respond to my allegations. After a period of time goes by, I get the same request for taxes from an IRS office in another state and the cycle starts all over again. Rather than answer any questions that would expose the fraud in the personal income tax, they are working very hard to dismiss my lawsuit, and deny me a jury trial.

Q-Where are the statutes that create a specific liability for federal income taxes?

Answer: Section 1 of the Internal Revenue Code (“IRC”) contains no provisions creating a specific liability for taxes imposed by subtitle A aside from the statutes which apply only to federal government employees, pursuant to the Public Salary Tax Act, the only other statutes that create a specific liability for federal income taxes are those itemized in the definition of “Withholding agent” at IRC section 7701(a)(16).

After a worker authorizes a payroll officer to withhold taxes, typically by completing Form W-4, the payroll officer then becomes a withholding agent who is legally liable for payment of all taxes withheld from that worker’s paycheck. Until such time as those taxes are paid in full into the Treasury of the United States, the withholding agent is the only party who is legally liable for those taxes, not the worker.

If the worker opts instead to complete a Withholding Exemption Certificate, consistent with IRC section 3402(n), the payroll officer is not thereby authorized to withhold any federal income taxes. In this latter situation, there is absolutely no liability for the worker or for the payroll officer; in other words, there is no liability PERIOD, specifically because there is no withholding agent.

Q-Can a federal regulation create a specific liability, when no specific liability is created by the corresponding statute?

Answer: No. The U.S. Constitution vests all legislative power in the Congress of the United States. See Article I, Section 1. The Executive Branch of the federal government has no legislative power whatsoever. This means that agencies of the Executive Branch, and also the federal Courts in the Judicial Branch, are prohibited from making law.

If an Act of Congress fails to create a specific liability for any tax imposed by that Act, then there is no liability for that tax. Executive agencies have no authority to cure any such omission by using regulations to create a liability. “[A]n administrative agency, may not create a criminal offense, or any liability, not sanctioned by the lawmaking authority, especially a liability for a tax or inspection fee.”

Q- How many classes of citizens are there, and how did this number come to be?

Answer: There are two (2) classes of citizens: State Citizens and federal citizens. The first class originates in the Qualifications Clauses in the U.S. Constitution, where the term “Citizen of the United States” is used. Prior to the Civil War, there was only one class of Citizens under American Law. The second class originates in the 1866 Civil Rights Act, where the term “citizen of the United States” is used. Notice the lower-case “c” in “citizen”. The pertinent court cases have held that Congress thereby created a municipal franchise primarily for members of the Negro race, who were freed by President Lincoln’s Emancipation Proclamation (a war measure), and later by the Thirteenth Amendment banning slavery and involuntary servitude. Compelling payment of a “tax” for which there is no liability statute is tantamount to involuntary servitude. Instead of using the unique term “federal citizen”, as found in Black’s Law Dictionary, Sixth Edition, it is now clear that the Radical Republicans who sponsored the 1866 Civil Rights Act were so attempting to confuse these two classes of citizens. Then, they attempted to elevate this second class to constitutional status, by proposing a 14th amendment to the U.S. Constitution. As we now know, that proposal was never ratified.

Q-Who was Frank Brushaber, and why is he so important

Answer: Frank Brushaber was the Plaintiff in the case of Brushaber v. Union Pacific Railroad Company, (1916), the first U.S. Supreme Court case to consider the so-called 16th amendment. Brushaber identified himself as a Citizen of New York State, and nobody challenged that claim.

The Union Pacific Railroad Company was a federal corporation created by Act of Congress to build a railroad through Utah (from the Union to the Pacific), at a time when it was a federal Territory, i.e. inside the federal zone.

Brushaber had purchased stock issued by the company. He then sued the company to recover taxes that Congress had imposed upon the dividends paid to its stockholders. The U.S. Supreme Court ruled against Frank Brushaber, and upheld the tax as a lawful excise, or indirect tax.

The most interesting result of the Court’s ruling was a Treasury Decision (“T.D.n) that the U.S. Department of the Treasury later issued as a direct consequence of the high Court 1 s opinion. In 27 T.D. 2313, the U.S. Treasury Department identified Frank Brushaber as a “nonresident alien, and the Union Pacific Railroad Company as a “domestic corporation”. This Treasury Decision has never been modified or repealed. T.D. 2313 is crucial evidence proving that the income tax provisions of the IRC are municipal law, with no territorial jurisdiction inside the 50 States of the Union. The U.S. Secretary of the Treasury who approved T.D. 2313 had no authority to extend the holding in the Brushaber case to anyone or anything not a Party to that court action. Thus, there is no escaping the conclusion that Frank Brushaber was the nonresident alien to which that Treasury Decision refers. Accordingly, all State Citizens are nonresident aliens with respect to the municipal jurisdiction of Congress, i.e. the federal zone.

Q-What is “tax evasion” and who might be guilty of this crime?

Answer: “Tax evasion” is the crime of evading a lawful context of federal income taxes. This crime can committed by persons who have a legal liability to pay a withholding agent. If one is not employed by the government, one is not subject to the Public Salary unless one chooses to be treated “as if” one is a government “employee.”

This is typically done by executing a valid Form W-4. However, as discussed above, Form W-4 is not mandatory for workers who are not “employed” by the federal government. Corporations chartered by the 50 States of the Union are technically “foreign” corporations with respect to the IRC; they are decidedly not the federal government, and should not be regarded “as if” they are the federal government, particularly when they were never created by any Act of Congress.

Q-Why does IRS Form 1040 not require a Notary Public to notarize a taxpayer’s signature?

Answer: This question is one of the fastest ways to unravel the fraudulent nature of federal income taxes. At 28 U.S.C. section 22 1746, Congress authorized written verifications to be executed under penalty of perjury without the need for a Notary Public, i.e. to witness one’s signature.

This statute identifies two different formats for such written verifications: ( l) those executed outside the “United States” and (2) those executed inside the “United States”. What is extremely revealing in this statute is the verifications executed “outside the United States.”

The statute adds the qualifying phrase laws of the United States of America”.

Clearly, the terms “United States” and “Unites States of America” are both used in this same statute. They are not one and the same. The former refers to the federal government — in the U.S. Constitution and throughout most federal statutes. The latter refers to the 50 States that are united by, and under, the U.S. Constitution.

It is painfully if not immediately obvious, then, that verifications made under penalty of perjury are outside the 50 States of the Union (read “the state zone”) if and when they are executed inside the “United States” (read “the federal zone”). Likewise, verifications made under penalty of perjury are inside the 50 States of the Union, if and when they are executed outside the “United States”. The format for signatures on form 1040 is the verifications made inside the United States(a federal zone) and outside the United States of America(state zone).

Q-What does it mean if my State is not mentioned in any of the federal income tax statutes?

Answer: The general rule is that federal government powers must be expressed and enumerated. For example, the U.S. Constitution is a grant of enumerated powers. If a power is not enumerated in the U.S. Constitution, then Congress does not have any authority to exercise that power. This rule is tersely expressed in the Ninth Amendment, in the Bill of Rights. If California is not mentioned in any of the federal income tax statutes, then those statutes have no force or effect within that State. This is also true of all 50 States.

Strictly speaking, the omission or exclusion of anyone or anything from a federal statute can be used to infer that the omission or exclusion was intentional. In Latin, this is tersely stated as follows: Inclusio unius est exclusio alterius. In English, this phrase is literally translated: Inclusion of one thing is the exclusion of all other things [that are not mentioned] . This phrase can be found in Black’s Law Dictionary. If a place is not mentioned, every American may correctly infer that the omission of that place was intentional.

Q-Has Title 26 of the United States Code (“U.S.C.”) ever been enacted into positive law, and what are the legal implications if Title 26 has not been enacted into positive law?

Answer-No,Congress has never passed a law enacting a federal income tax for every American citizen. If you go online or ask a congressman, or senator, if you are required to pay a “federal personal income tax”. They will tell you that the 16th amendment requires you to pay personal income taxes on your labor. That statement is false- the 16th amendment was never ratified and I can prove it.

The TRUE holding by the Supreme Court, is that the 16th amendment

1) did not amend the constitution;

2) did not authorize a direct, unapportioned income tax;

3) did not grant Congress any additional taxing authority— none;

and 4) it’s sole affect is to prohibit the Supreme Court from considering the source of income in determining whether an income tax is a direct unapportioned tax or a indirect tax.

Q-What is the status of your Federal Case?

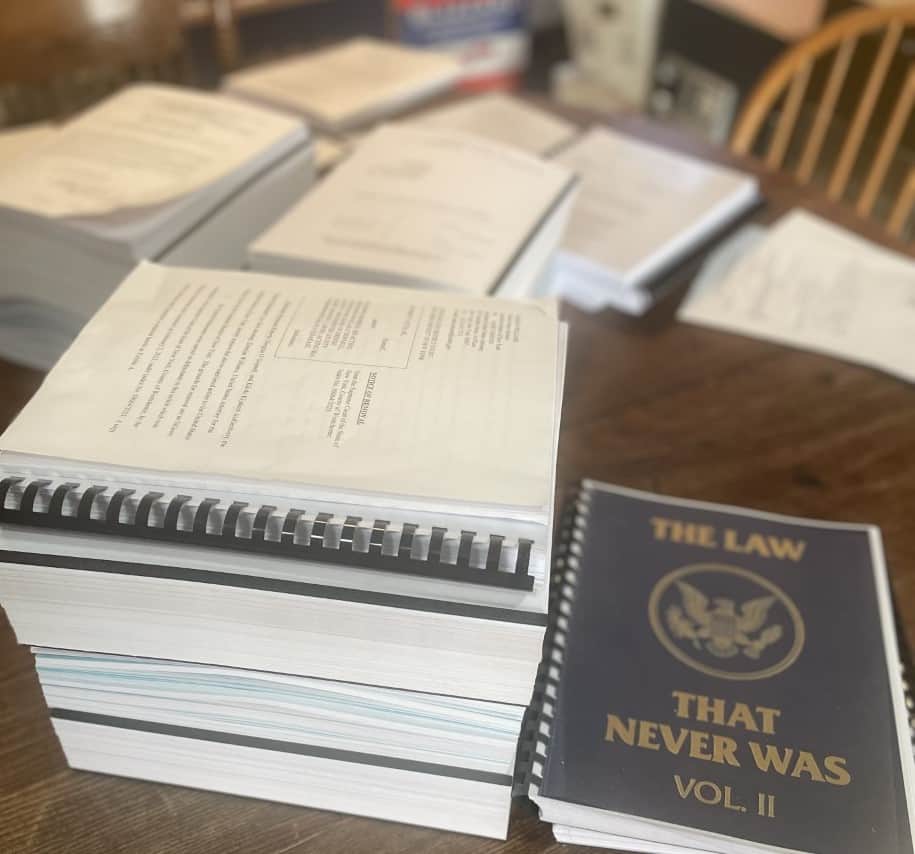

Answer-I have filed a case in federal court (civil law )against the United States government(requesting trial by jury).I have also filed a case in state supreme court(common law trial by jury)against two IRS agents, the Social Security administrator, Chase Bank and the Bank of Greene county for liens placed upon my property. The federal government has made a motion to move my case from the New York State Supreme Court to federal court.

A jury trial that government will try to deny me would expose the biggest fraud on the American people in the history of this great country.