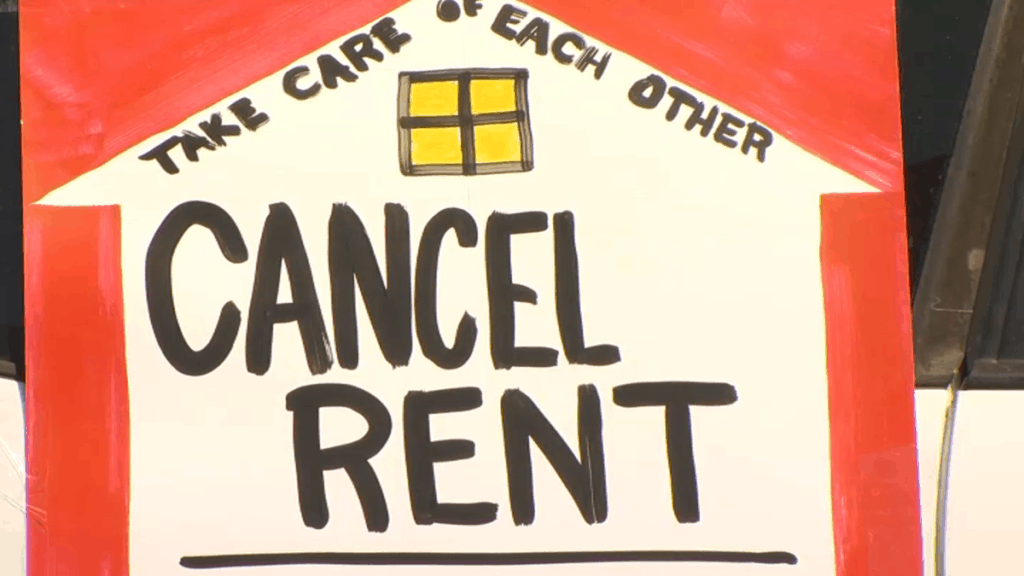

As many Americans have lost their job and begin to run out of money, progressive groups have begun the call for the cancellation of rent, and in delays of mortgage payments. “Rent strikes are proliferating across the country as newly unemployed renters deplete the last of their meager cash reserves during the COVID19 crisis. Congress is preparing an additional COVID19-related economic relief bill over the next several days, and renter protections will be a crucial point of conflict in those negotiations. We advocate for Congress to cancel rent for the duration of the COVID19 crisis,” writes Tara Raghuveer, from People’s Action, a progressive organizing group.

“Renters Are in Crisis. Roughly 20 percent of the U.S. workforce is newly unemployed due to the COVID19 pandemic. Before the pandemic, three-in-five renters could not pay $400 in cash for an emergency. Forty-seven percent of renters spent more than a third of their income on rent.

“As eviction moratoriums end, huge rent-related debts, hits to credit scores, and evictions loom for millions of renters who could not pay the rent in April, May, and beyond. While some policymakers have proposed merely upping funding for traditional rental assistance, that approach would fail to meet the scale of the crisis. That’s because rental assistance puts the burden on cash-strapped, crisis-mode renters to navigate bureaucracies and apply for relief and means testing and other restrictions mean that rental assistance will miss large segments of those who need it most.

“Instead of one-time rental assistance, Congress should cancel rent and mortgage payments for the duration of the crisis. H.R. 6515, the Rent and Mortgage Cancellation Act introduced by U.S. Rep. Ilhan Omar, provides the best hope for renter relief during this crisis. The bill calls for: Rent payment suspension for the duration of the crisis, meaning no rent obligation, no late fees, and no retaliation; Mortgage payment suspension for the duration of the crisis, meaning no mortgage payments, no debts, and no retaliation,” writes Raghuveer.

The bill, proposed by Congresswoman Omar, who is a member of the squad, with fellow progressive congresswoman Alexandria Ocasio-Cortez, Rashida Tlaib and Ayanna Pressley, has no chance of passing in the US Senate, led by Republican Majority Leader Mitch McConnell.

What about the landlords and lenders who will not be receiving their payments? Omar’s bill proposes that the Department of Housing and Urban Development, (HUD) would pay back some landlords through a relief fund and a separate relief fund would be set up for some lenders. We stipulate “some landlords” and “some lenders” because not everyone gets bailed out from Uncle Sam.

Both relief funds will reimburse landlords and lenders for lost rent and mortgage payments. Without taking a deeper dive into who will pay for this relief fund, (my daughter and your children and grandchildren because we are printing money and borrowing all of this “stimulus spending), there is a stipulation in Omar’s bill for landlords and lenders. They must agree to fair renting and lending practices for five years.

And if a landlord can’t afford to provide free rent in anticipation of a Federal relief program, Omar wants to create an affordable housing fund to buy the rental properties and create affordable housing.

Here in New York, Governor Andrew Cuomo expanded the eviction moratorium from June 20 to August 20. Landlord groups, like the Under the Roof coalition, say that many landlords are small businesses, or mom and pop investors, who need rent money to pay their bills.

Landlords need to pay their staff, (porters, superintendents) and pay their utilities and property taxes, and most landlords have mortgage payments as well. One landlord in Yonkers that we know told us, “I have to pay for my employees because they have rent to pay and a family to feed. I have water bills and sewer bills and utilities to pay every month to make sure that my building is safe and clean for my tenants. And what about my renters who can afford to pay their rent? Should they have their rent cancelled as well?”

The lenders that Omar refers to in her bill are mostly banks. We bailed out the banks in the financial crisis of 2008, which went on until 2010 and was much less of an economic crisis than the one before us. But many progressives did not agree with the decision back then to “bail out the banks,” and if mortgage payments are delayed along with rent payments, won’t the banks be seeking the same type of relief?

Even in Senator McConnell’s home state of Kentucky, the #CancelRent movement is gaining ground. “instead of bailing out cruise line companies you need to be putting your focus and priority making sure Americans have the ability to stay in their homes. You need to put resources towards housing,” said Eric Dunn, from the National Housing Law Project.

One proposal that makes some sense for mortgage payments would be for banks to move three months of mortgage payments due now to the end of the loan, which would just extend the length of the mortgage. But how can this be done on a rental apartment lease?