By Dan Murphy

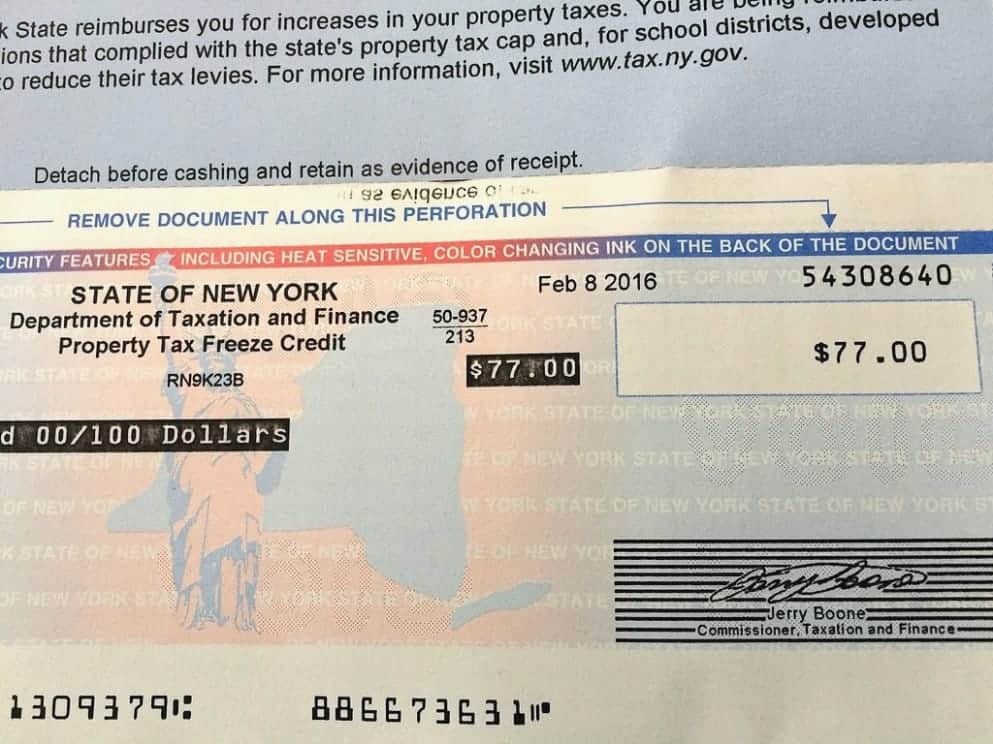

For four years, New York homeowners have been mailed a gift from the State of New York Department of Finance. A check, in the form of a rebate for property tax relief, was usually mailed out during an election year for State Senate and Assembly, and also usually mailed out in the fall of that year – coincidentally – weeks before the November election.

The check averaged around $450 for a Westchester homeowner, who pays on average more than $17,000 per year in property taxes – still the highest property taxes in the USA. For my family, as with every family, the rebate checks were welcomed and were around $300 per year.

The three-year plan, started by Gov. Andrew Cuomo in 2016, was created, in part, to encourage local governments and school districts to stay at or below the state-mandated property tax cap every year. Local governments and school districts that stayed below the cap enabled homeowners to get the check; those homeowners whose communities exceeded the cap did not get the rebate check.

The incentive, and disincentive, was likely not known by most Westchester homeowners, but it was discussed in some local governments who were talking about passing a budget that exceeded the cap. In the City of Yonkers, Mayor Mike Spano and the City Council recently were passed a budget with a 6 percent property tax increase– well above the tax cap – and that year homeowners didn’t get the check.

Overall, more than 95 percent of the local governments and school districts in Westchester, and in New York State, did not override the tax cap during this time. And for the Westchester homeowners and overburdened property taxpayer, let’s hope it stays that way.

This year, the $1.2 billion property tax relief program expired. And with NYS facing a $6 billion budget hole (Cuomo says it’s $6 billion, other leaders in Albany say it’s more likely around $4 billion), there was no money to renew it.

Last year, the state made the property tax cap permanent, which some have explained is one reason not to have to extend or renew the rebates. This newspaper, and many good government groups, have always believed that the rebate checks were an election year gimmick, so if our state government does have a budget shortfall, then those rebate checks should go.

E.J. McMahon from the Empire Center for Public Policy said: “It was like the Memorial Day parade when the firefighters throw the Tootsie Pops off the back of the truck, and was simply dropping money from helicopters for homeowners only.”

There is a difference between the rebate checks the we got in the mail in the fall of a state election year and the STAR rebate checks and direct credits that thousands of Westchester residents, seniors and New Yorkers get every year.

STAR, the School Tax Relief Program, was created by Gov. George Pataki in 1998 as a way to relive homeowners from school property taxes, which make up 70 percent of a homeowner’s property tax bill. The original basic STAR program made the first $30,000 of a home’s estimated full value exempt, with no limit on the homeowner’s income. Now there are limits on income.

The STAR program costs $3 billion a year and gives homeowners who earn less than $500,000 a year a break on their school taxes – either as an upfront savings or in a check.

Also, most homeowners do not get a STAR check in the mail; it is directly credited to their school property tax bill. Many of our readers, and Westchester homeowners, may not even know they still receive a STAR rebate, because it directly comes off their school tax bill and if you don’t read your property tax bills, you won’t see it.

Seniors with income of $75,00 or less can also receive the enhanced STAR program, which is about one-third of their regular STAR credit.

Westchester members of the Assembly and Senate all agree: They will protect the STAR program at all costs and do not want any changes made to it, while the rebate checks are an understandable casualty of New York’s spending on programs like Medicaid, which also includes senior care for many in Westchester.

Cuomo and the State Department of Finance have made changes to the STAR credit received by new homeowners coming into NYS and Westchester; anyone who has annual income between $250,000 and $500,000 receives a check instead of the direct savings. But those homeowners who have lived in Westchester for more than five years still get the direct credit.

Two Westchester state legislators have opposed the STAR changes for new homeowners. Assemblyman Sandy Galef, who is chairwoman of the Assembly Committee on Real Property Taxation, said on the difference between the STAR program and the state rebate checks, “I would rather protect the STAR program that we have. It’s nice to get a check from the State of New York, but a lot of people don’t know what it is about,” she said.

“We cannot continue to negotiate away this vital tax benefit year after year in the budget. I have seen a steady increase in constituent outreach over the last few years from STAR and Enhanced STAR recipients who are simply unable to wrap their heads around the changes to their benefit.”

Assembly member Amy Paulin and State Sen. Pete Harckham said calls and complaints about the STAR program are the number one concern they hear from their constituents.

“Over the last few years, my office has received more questions on STAR than any other benefit or program offered by the state, many of them from confused and concerned residents and taxpayers, often seniors on a fixed income,” said Paulin.

“The number-one complaint I get in my office is from constituents regarding the STAR program,” added Harckham. “So to further exasperate those problems, rather than streamline and have a solution to those problems, is very frustrating.”

The real concern about STAR is that, during one state budget crisis, it is eliminated. If new Westchester homeowners making $300,000 per year have to receive a check, and don’t get the credit off their school tax bills like the rest of us, so be it.

Every year that STAR is protected is another year all of us pay almost $1,000 per year less in property taxes. Thank you, Gov. Pataki, and thanks to Gov. Cuomo for keeping STAR.

About 3 million New Yorkers get breaks each year on their school property taxes through STAR, and 665,000 seniors get Enhances STAR. Basic STAR averages $790 per year, and enhanced STAR averages $1,381 per year.

One STAR change that all of us should have no problem with is the loophole that was closed for those who don’t pay their school property taxes. Now, if you don’t pay your property taxes, you don’t get your STAR credit. “If someone is not paying their fair share, they should not be entitled to STAR,” said Cuomo.