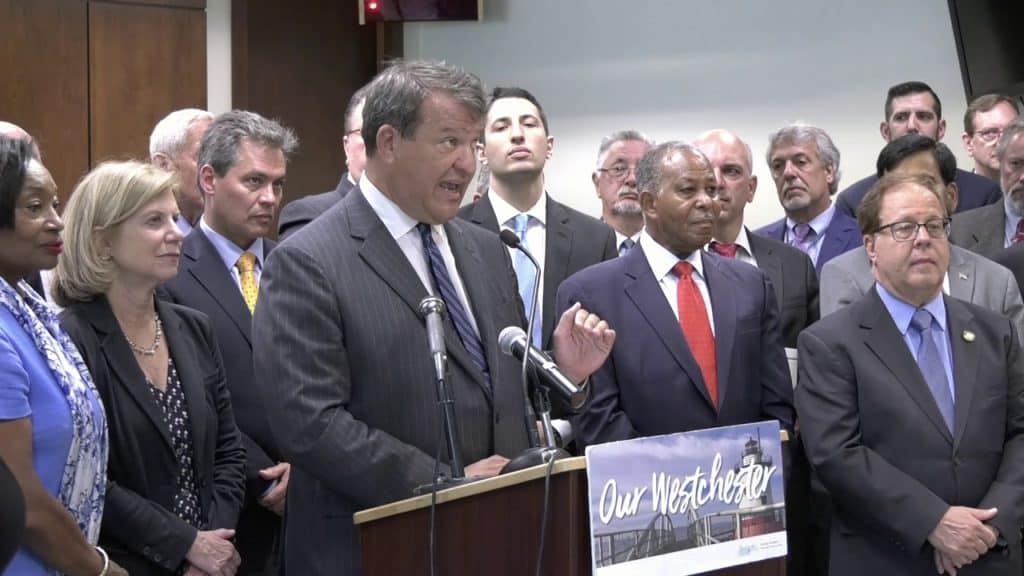

Focused on taking the burden off Westchester County property taxpayers and combating the loss of the federal SALT deduction, Westchester County Executive George Latimer announced a series of actions in response to Gov. Andrew Cuomo signing the Westchester County Property Taxpayer Protection Act. The announcement came during a press conference with nearly 60 elected officials, government leaders and school district leaders, and advocates from both sides of the aisle, standing in solidarity with the county executive.

Latimer said he will sign an executive order to prohibit the county from independently selling county parkland that is more than 2 acres, introduce budget amendments to stop the sale of county parking lots, move $5 million to the county’s reserve fund, direct the Departments of Budget and Finance to freeze county property taxes for two years (2020 and 2021), and direct 20 percent of the nearly $70 million collected to local municipalities and 10 percent to the school districts.

Additionally, the news that the county – which currently has an AA+/negative bond rating from S&P – has increased its sales tax rate has been deemed a tremendous step forward in improving the county’s bond rating. According to S&P Global Ratings, the increase is “a step toward restoring budgetary balance and will likely have a positive credit impact.”

“Today is the end of one-shot revenues and borrowing for operating costs,” said Latimer. “We now have a creative source of revenue that is not an additional burden on the county’s property taxpayers. This tax freeze will help address the expected increases for many residents and taxpayers from the new federal tax plan.”

Senate Majority Leader Andrea Stewart-Cousins said this law, requested by the county government, allows Westchester to have greater parity with neighboring counties while directly helping overburdened local governments and providing much-needed funding to local schools.

State Sen. Shelley Mayer said she was pleased to be a Senate prime sponsor of the bill. “The projected sales tax share for the remainder of 2019 will provide an additional $390,000 for the Port Chester School District, and more than $400,000 for the Ossining School District,” she said. “Creating parity in local sales tax rates is a fiscally prudent step forward for Westchester County and will have a positive impact on our municipalities and local school districts.”

Assemblyman Tom Abinanti added: “The additional sales tax is a revenue-raising alternative to property taxes to fund basic and necessary services. The sharing formula in the legislation ensures that localities and school districts get additional revenue to ease the burden on local property taxpayers.”

As a representative of portions of Westchester and lifelong resident of the county, Assemblyman David Buchwald said he recognized that “we needed to act to put the county budget back on solid financial ground.”

Assemblyman Steve Otis said that stabilizing county finances, freezing county taxes and property tax relief for school and municipal taxpayers are steps in the right direction toward providing relief for taxpayers.

Assemblyman Nader Sayegh noted that Westchester doesn’t only have the highest property taxes in New York State – but it is the highest taxed county in the nation. “The Westchester County Property Taxpayers Protection Act generates revenue while providing relief to our county homeowners without raising property taxes,” he said. “This is a smart and effective policy that will protect thousands of homeowners whose lives have been impacted by recent changes in the federal tax code over the last year.”

Board of Legislators Chairman Ben Boykin said the measure will stabilize Westchester’s finances, allow the county to rebuild its fund balance, and ensure it can continue to provide essential services to residents. “It also will bring millions of new dollars to our school districts and municipalities,” he said. “That will help mitigate the burden on the County’s property taxpayers.”

Dobbs Ferry Mayor Robert McLoughlin said the Village of Dobbs Ferry has kept real estate taxes below the 2 percent cap for the last decade and has not increased the tax rate for the last two years. “Thanks to George Latimer’s 1 percent sales tax increase, it spreads the burden over a much broader group of people rather than just increasing property owners taxes,” he said. “We stand to receive more than $500,000 of additional revenue that will help us with our efforts to maintain and rebuild our infrastructure including roads, sidewalks, sewers, technology and first responder safety equipment.”

Greenburgh Town Supervisor Paul Feiner noted that Westchester has the distinction of having the highest property taxes in the country. “I think this legislation is an important action step that will help us get rid of this unwanted distinction,” he said.

Harrison Councilman Frank Gordon said the initiative provides Harrison with a more solid financial footing on which to foster its programs for residents, from young families to older adults.

Mamaroneck Village Mayor Tom Murphy said the village is grayed for the additional revenue from the sales tax increase. “We will use the windfall to keep our tax increase under the cap and provide the services our residents have come to expect,” he said.

Mamaroneck Town Supervisor Nancy Seligson said the governor’s approval of the increase in sales tax for Westchester County is “a win” for the county budget and will help the town’s budget, as well.

Mount Pleasant Councilwoman Laurie Rogers-Smalley added: “Anything we can do as a local government body to relieve our residents of the burden of property taxes is welcomed. The increase in sales tax gives the consumer the opportunity to control the amount of tax they pay by carefully scrutinizing their purchases. It is hoped that this will stabilize the recent increases in property taxes and give Westchester County residents much needed tax relief.”

North Castle Town Supervisor Michael Schiliro said the additional revenue will be used to provide further taxpayer relief to residents.

Ossining Town Supervisor Dana Levenberg said she is pleased with the initiative to bring Westchester in line with neighboring municipalities while also giving the town another revenue source to help pay for much-needed infrastructure improvements. “Responsible governance means understanding that having resources to maintain our public assets saves us all in the long run,” she said.

Ossining Village Mayor Victoria Gearity said greater sales tax revenue for Ossining means the village can preserve local services without raising property taxes. “That’s critically important in our community, where our effective tax rate is high,” she said.

Peekskill Deputy Mayor Kathleen Talbot said returning more tax dollars to municipalities – especially lower-income ones like Peekskill that struggle to meet the tax cap each year – will boost the city’s ability to achieve more green initiatives to help meet its 2030 sustainability goals.

Port Chester Village Trustee Frank Ferrara said the plan for the village is to put the revenue that’s received this year into a reserve fund to offset any unanticipated emergency spending that was not included in this year’s village budget.

Rye City Mayor Josh Cohn said the funds derived from the increase will help “with the enormous infrastructure spending we must undertake and ease the burden of that spending on our property taxpayers. Although any tax increase gives us pause, we welcome this one,” he said.

Tuckahoe Schools Superintendent Carl Albano said the additional revenue will offset the expense of the expansion of Tuckahoe’s school counseling program this year, “which will enable us to effectively support the needs of our students and families.”

Yonkers City Council Majority Leader Michael Sabatino added: “The Property Taxpayer Protection Act will help the county fund the necessary services it provide without raising the property taxes. This will allow for a balanced budget, a freeze on county property tax and sale tax parody throughout the county. It will also elevate the bond rating for the county.”