By Tony Futia

My legal battles with the IRS and with New York State officials who allowed the IRS to take a large part of my pension without my approval continue.

Here is my central argument: There is no statute or federal law that requires Americans to pay federal income taxes. Only Federal employees must file and pay federal income taxes. For the rest of us, there is no law that requires us to do so.

Many of you are familiar with a W4 form, which employers ask you to fill out to determine how much of your income will be withheld so that the IRS has some of your income put aside to pay your income tax.

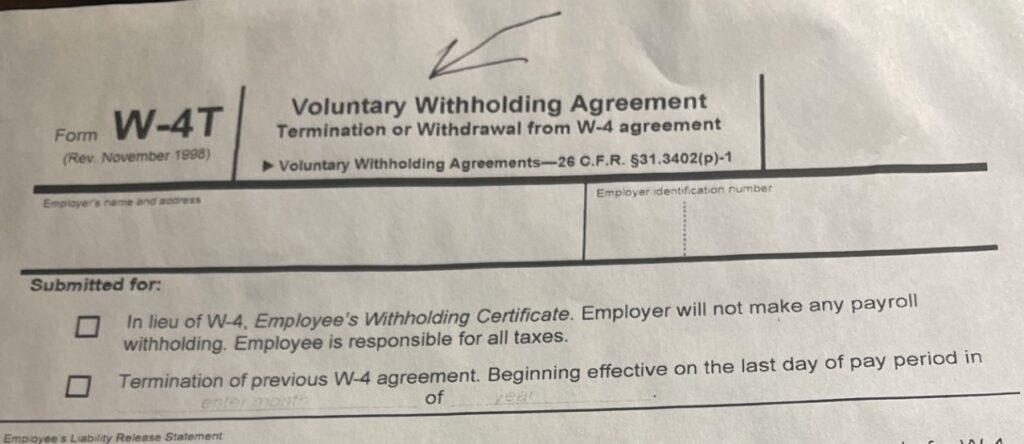

But most of you may not be aware of Form W-4T. It’s the form the IRS does not want the public to see, and for many years, it was not listed in the IRS forms catalog.

A W4T form is a way for you and any employee to tell their employer that they don’t want ANY of their salary withheld to pay for their income tax. A printed part of the W4T form to show you what it says, “Voluntary Withholding Agreement.”

I argue that all payments by most Americans when they pay their Federal Income Tax is VOLUNTARY. The only Americans required to pay their Federal Income Tax are Federal Employees and citizens who live in Federal Possessions like Washington, DC, and Puerto Rico.

During my later years working for the Town of North Castle, I filled out a W4T, and told the Town that I did not want any withholding for my income tax.

You can do the same thing. But, if you want to pay your income tax at the end of the year, you need to put the amount you can estimate you owe into a bank account or other investment.

That is your way of not giving an interest-free loan to the Federal government.

We The People, the organization that I am a proud member of, want our day in court to argue that the 16th Amendment to the US Constitution, ratified in 1913, does not require every American to pay a federal income tax. The Amendment establishes “Congress’s right to impose a Federal Income Tax.” Before 1913, there was no Federal Income Tax in the US.

Our nation’s bills were paid by collecting revenue from Tariffs, Duties, Fees, and Excise Taxes. If this sounds familiar, this is what President Trump is trying to get to, and it is something that I support completely. \

Article One, Section 8 of the US Constitution, lays this out: (excise taxes, tariffs, duties, and imports) The revenues raised will create more than enough money to run the country if wasteful spending is eliminated. The Founding Fathers were brilliant.

The 16th Amendment does not say that a Federal Income Tax Should Be Imposed on every American citizen. It is this ambiguity and the fact that Congress has never passed a law requiring everyone to pay a federal income tax, that I and We, the People, have been asking the IRS and the courts to answer for more than twenty years.

When most of us file our federal taxes, we do so voluntarily. The IRS reviews what you have agreed to pay and audits you if their figures don’t agree with yours. Most of the challenges from the IRS come in the form of underpayment from those who filed a return.

But for those like me who have not filed a return, the IRS really isn’t sure how to proceed. Many do not file a return every year to escape payment, but I’m doing this on principle.

There is no law that says that the average American citizen must pay an income tax. Most people don’t want to hear about this. They want to go about their lives, pay their taxes, and be left alone. But I think there are many of us out there who wonder, where are my tax dollars going? I’m willing to take that risk for my children and grandchildren.

The IRS relies on numerous inferior court cases. Inferior courts are those inferior to the Supreme Court and consist of tax and claims courts, bankruptcy courts, district courts, and appeals courts, all created by Congress. The IRS acknowledges in its Internal Revenue Manual that inferior court holdings Are not law and are binding only on the parties to the suit in question, and even then, only as to the years litigated. According to the IRM. (Internal revenue manual.) Only Supreme Court cases are binding on it, and the law of the land is considered “equivalent to the code.”

Why would the IRS rely so heavily on so many cases it considers neither binding nor the law of the land? In virtually every instance, the statement by the court being relied upon by the IRS is not actually a holding, a ruling, or a conclusion necessary to a ruling on an issue before the court. The vast majority of such cases “holdings” are actually “dictum” extraneous statements, by the court of its opinion. In other such inferior court cases, the case is selected by the IRS simply because it is wrong.

Below is a letter to the Editor, Dan Murphy, who I thank for allowing me to share my opinions on a matter that most would not want to touch with a 10-foot pole.

To the Editor,

Government is Limited by WE THE PEOPLE’S written constitutions! THERE IS NO LAW.

The federal government cannot produce a law requiring most NEW YORK STATE residents to pay a personal federal income tax on their labor unless they are federal employees, residents within a federal possession, or VOLUNTEER to pay by signing a W-4 Withholding certificate!

Question: Where are the statutes that create a specific liability for federal income taxes?

Answer: Section 1 of the Internal Revenue Code (“IRC”) Contains no provisions creating a specific liability (“libel “) for taxes imposed by subtitle title A. Aside from the statutes, which apply only to federal government employees pursuant to the federal public salary tax act (permitted as a direct tax on labor by the federal constitution but not constitutional in the 50 states constitutions,) the only other statutes that create a specific liability for federal income taxes are those itemized in the definition of “Withholding agent” at IRC section 7701 (a) (16).

After a worker voluntarily authorizes a payroll officer to withhold taxes, typically by completing form W-4, the payroll officer becomes a withholding agent who is legally liable for payment of all taxes withheld from that worker’s paycheck. Until such time as those taxes are paid in full into the treasury of the United States, the withholding agent is the only party who is legally liable for those taxes, not the worker. See IRS Section 7809(“Treasury of the United States”).

WITHHOLDING EXEMPTION AGREEMENT

A “Withholding Exemption Certificate” is an alternative to form W-4.

Suppose the worker opts instead to complete a withholding exemption certificate (W4-T, capitol T ) consistent with IRC section 3402 (n). In that case, The payroll officer is not authorized to withhold any federal income taxes. In this latter situation, there is no liability for the worker or payroll officer. In other words, there is no liability PERIOD precisely because there is no withholding agent.

For many years, because the IRS did not add this form to its “printed products catalog,” many public and private institutions have created their own form for the withholding exemption certificate,

i.e., California franchise tax board and Johns Hopkins University in Baltimore, Maryland.

This certification is easy to justify because there are no liability statutes for workers in the private sector.

Sincerely, Anthony Futia Jr. N. White Plains.