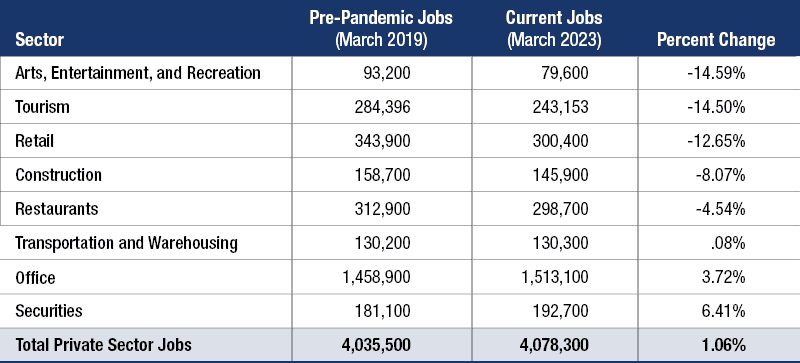

Arts, Tourism, Retail Lagging but 4 Million Jobs Total in 2023, Same as 2019

New York City has recovered 99.4% of private sector jobs it lost in the pandemic, but unevenly across key industries, according to an analysis released by New York State Comptroller Thomas P. DiNapoli.

“The city’s job recovery is good news,” DiNapoli said. “We are seeing strength in the securities, transportation and warehousing and office sectors, but retail, restaurants, construction and tourism continue to lag the national recovery. We need these sectors, which employ hundreds of thousands of workers, to also regain their full pre-pandemic strength to ensure the city’s economic recovery is more robust and inclusive of all New Yorkers.”

Comptroller DiNapoli monitors several industries vital to the city’s comeback and provides monthly updates on the New York City Industry Sector Dashboards, which he launched last year. Key findings across the arts, entertainment and recreation, construction, office, restaurants, retail, securities, tourism and transportation and warehousing sectors include:

Arts, Entertainment and Recreation

- The arts, entertainment and recreation sector saw an uptick in employment in March of 2023.

- The sector has recovered only about 85% of pre-pandemic jobs, lagging the national job recovery rate for the sector of 96.4%.

- Broadway reopened in September 2021 and makes up one of the largest shares of arts jobs but has been slow to come back. Attendance exceeded pre-pandemic levels for the first time in January of 2023, but has since remained below pre-pandemic levels.

- As of March 2023, the restaurant sector has recovered 95.5% of pre-pandemic jobs, slightly below the rest of the state at 97.3%, and the nation, which has already fully recovered.

- At the height of the pandemic, restaurants lost 73% of jobs compared to 22% in the rest of the private sector.

- Retailers have only regained 87.4% of jobs in New York City compared to the nation which fully recovered its retail jobs as of March 2023.

- The retail sector saw a 33% drop in jobs between March and April 2020 due to pandemic and mandatory closures of non-essential retail businesses.

- The city’s Fiscal Year (FY) 2024 financial plan does not expect the sector to recover its pandemic job losses before 2027.

- The sector has yet to recovery nationally, and tourism employment in the city is still nearly 15% below the pre-pandemic level at the end of the third quarter in 2022.

- Hotel occupancy was about 74% in 2022, far below pre-pandemic levels.

- As of March 2023, the construction sector has yet to regain 8% of its pre-pandemic jobs. Year-to-date activity in 2023 lags the same period last year, although construction activity was strong in 2022.

- At the onset of the pandemic, the construction sector lost 46% of its jobs compared to only 22% for the private sector, as New York State paused nonessential construction.

- Over the last year, the sector has been hit by the rising interest rate environment influenced by the Federal Reserve’s actions to combat high levels of inflation.

- The securities sector did not see a notable drop in employment at the onset of the pandemic, as employees were able to shift to remote work.

- While the sector has experienced fluctuations in employment, job growth in the city continues to surpass that of the rest of the state. The sector is currently 6.4% larger than in 2019.

- Sector profits reached $25.8 billion in 2022, 55.8% less than the prior year.

Transportation and Warehousing

- The sector has recovered pandemic job losses despite being hard hit at the onset of the COVID-19 pandemic.

- Employment growth was especially strong in warehousing and storage, and courier and messenger services, due to increased demand for e-commerce.

- The Port of New York and New Jersey surpassed Los Angeles and Long Beach, California to become the biggest port by number of large shipping containers.

- The office sector, which includes the information, financial and real estate, and professional and business services industries regained pandemic job losses by January 2022.

- As of March 2023, jobs in the sector were almost 4% above the pre-pandemic level in 2019.

- Workers continue to return to the office, with the latest data showing an office occupancy rate of nearly 60% on peak days such as Tuesdays. However, concerns over commercial office space linger as vacancy rates remained at 22.2% in the first quarter of 2023.

These dashboards follow a series of reports DiNapoli’s office released over the past two years on the effect of the pandemic on these sectors.