New York State Comptroller Thomas P. DiNapoli today announced that the New York State Common Retirement Fund’s investment return was 11.55% for the state fiscal year that ended March 31, 2024. The Fund closed the year with an estimated value of $267.7 billion.

“Strong performances across asset classes helped drive the state pension fund’s investment returns higher over the past year, with many companies reporting better than expected earnings and consumer spending remaining strong,” DiNapoli said. “While inflation persists and global tensions pose risks to investors, the Fund, thanks to its prudent management and long-term approach, is well positioned to weather any storms and continue to provide retirement security to the public employees it serves.”

The Fund’s value reflects retirement and death benefits of $16.07 billion paid out during the fiscal year. Employer contribution rates are determined by investment results over a multi-year period along with numerous other actuarial assumptions, including wage growth, inflation, age of retirement, and mortality. Integral to the Fund’s strength have been the state and local governments, which consistently pay their contributions.

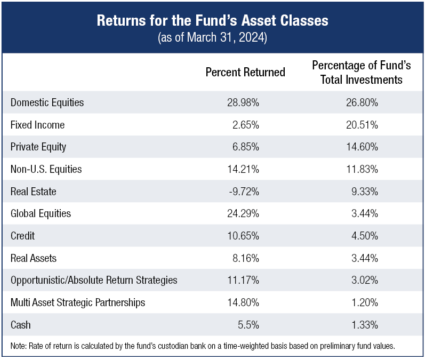

As of March 31, 2024, the Fund had 42.85% of its assets invested in publicly traded equities. The remaining Fund assets by allocation are invested in cash, bonds and mortgages (22.26%), private equity (14.60%), real estate and real assets (12.77%) and credit, absolute return strategies and opportunistic alternatives (7.52%).