Mortgage rates continued to climb in August, nearing seven percent, while the inventory of homes across New York State continued to drop to near record lows, according to the housing report released by the New York State Association of REALTORS®.

Interest rates continued their upward trajectory in August, according to Freddie Mac. The monthly average on a 30-year fixed rate mortgage jumped up from 6.71 percent in June 2023 to an average of 6.84 percent last month. A year ago, at this time, the average monthly rate was 5.41 percent.

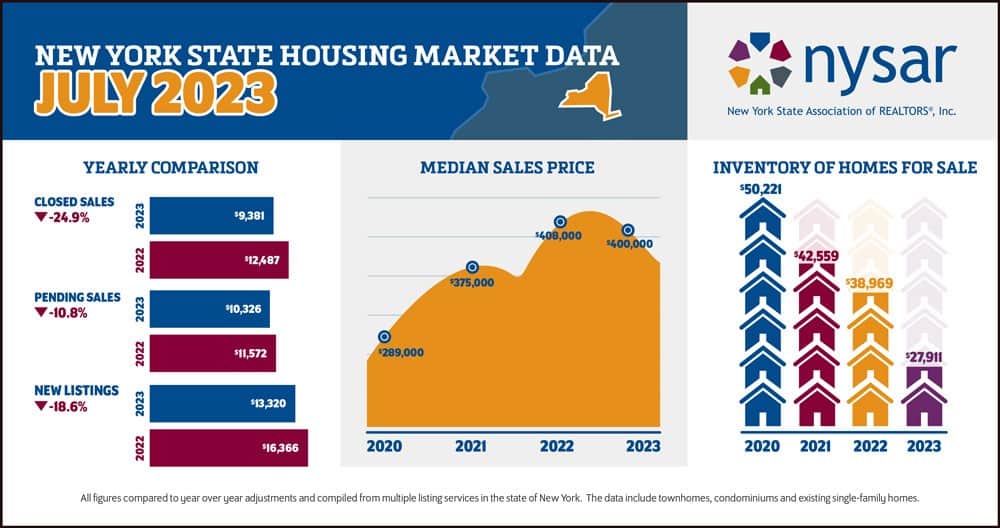

Inventory of homes for sale across the Empire State fell from 38,969 homes in July 2022 to just 27,911 units last month, representing a 28.4 percent decline. This marks 45 consecutive months that the number of homes available has fallen in year-over-year comparisons.

Closed sales fell 24.9 percent – from 12,487 in July 2022 to just 9,381 homes in July 2023. Pending sales were also down, falling to 10,326 units. This marks a 10.8 percent drop from the 11,572 pending sales in July 2022 in year-over-year comparisons. New listings also declined, dipping 18.6 percent from 16,366 listings in July 2022 to only 13,320 homes on the market last month.

Median sales prices remained comparable to 2022, falling two percent from $408,000 last July to $400,000 in July 2023.

Additional data is available at http://www.nysar.com/industry-resources/market-data.