By Dan Murphy

Westchester homeowners and taxpayer struggling to make ends meet during the pandemic have been given tax relief in the submission of a 2022 budget from Westchester County Executive George Latimer, and in the Town’s of Greenburgh and Yorktown, from Supervisor’s Paul Feiner and Matt Slater.

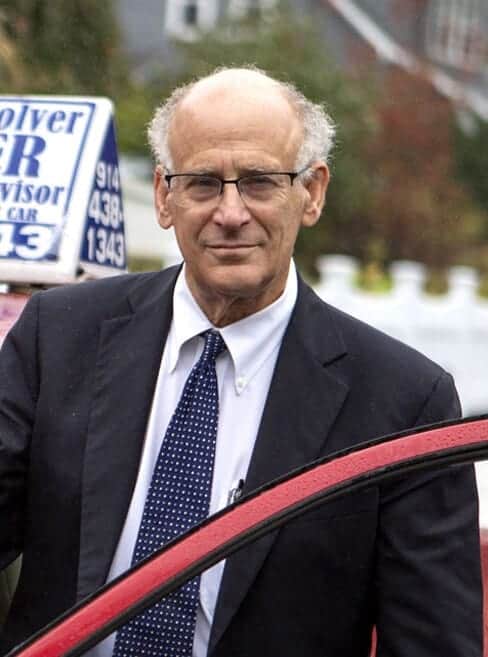

In Greenburgh, Supervisor Paul Feiner has proposed a 2022 budget with a zero dollar increase in the property tax levy. Total spending in Feiner’s budget plan is $28.7 Million, down $4.1 Million from 2021.

“Let me begin by informing you that after an exhaustive review of the 2021 budget, I am pleased to announce that I will be submitting to the Town Board for their approval, 2022 Annual Town Budgets, both for the Town Entire and the Unincorporated Town, with ZERO DOLLAR increases in Property Tax Levy. This will be the third consecutive year of ZERO DOLLAR Property Tax increases, which the Board and I strongly believe is an absolute necessity in this most trying fiscal time, for our constituents.

“It has been evident for quite some time that Federal, State and Local governments across every region of our Country are struggling with increased cost and decreased revenue, due to the continuing economic impact of the COVID 19 Pandemic. These extraordinary fiscal factors require municipal leadership to identify and employ every conceivable budgetary option available, to ensure the current life safety and financial viability of our constituency, without increases in Property Taxes, which would add to the already significant burden caused by the Pandemic.

“The budget I will be proposing for 2022 projects no increase in Property Tax. Thus, we project that the 2022 Tax Levy will remain the same as in 2021. Once again, these actions will place the Town under the NYS “Tax Cap,” providing taxpayers with eligibility for a refund which would be provided by NYS.

“PANDEMIC FEDERAL AID: The Town has been able to secure a one-time grant equal to approximately $9.5 million from NYS. These funds will be distributed based upon a population-based formula; therefore approximately 50% of these funds have or will be disbursed directly to each of the Villages and 50% to the Unincorporated Town.

“SALES TAX REVENUE: The inability of local business to generate sales in a Pandemic is obvious. Not so obvious is the reality that the Sales Tax Revenue generated by purchases within our Town may also be affected. Sales Tax revenue was decreased in 2021, from Pre-Pandemic levels, as expected. The projection for 2022 will assume slightly increased revenues over 2021, but not to Pre-Pandemic levels.

“Hiring will be limited to essential positions, contracts for the purchase of operational items will be more intensely scrutinized and deferred where possible and some programs could also be reduced, deferred, or cancelled until we feel it is physically safe and appropriate to go fully forward. There have been requests by some departments for additional positions.

These requests have not been included in the budget. The Town Board has asked that they collectively decide whether the positions are absolutely needed during difficult times,” wrote Feiner, who added that all union contracts have been settled and funded in his budget plan.

In the Town of Yorktown, Supervisor Matt Slater, proposed a 2022 budget that will not increase taxes for homeowners, and protects a tax cut that Slater and the Town Board were able to implement last year.

Under the proposed $63 million budget, the average home assessed at $10,000 would see an increase in special district taxes from $9 to $15, depending on where the home is located. Taxpayers in districts with existing sewer bonds will pay more due to the obligated debt.

Town taxes, which fund the general operating budget including the library and highway department, make up 12% of the total property tax bill. Other portions of the tax bill include refuse and recycling service, fire and EMS and water.

“We were able to protect taxpayers, make important investments to grow the economy, protect the environment, and improve our quality of life, all while dealing with the extraordinary adversity of the past year,” said Supervisor Slater.

“My proposed budget will hold the line on taxes by not increasing the general operating budget of our Town. It allows us to maintain services, increase our paving budget and makes new investments in our youth and environment.”

Supervisor Slater also described the many accomplishments that Yorktown logged in 2021. Completed work included three bridge replacement projects, five playground renovations, the conversion of 260 streetlights to LEDs, and a record 16.5 miles of local roads paved.

On the economic development front, Supervisor Slater noted that the Jefferson Valley Mall is almost 90% full. Earlier this month, the nation’s leading residential developer, Toll Brothers, introduced a potential project to the Town while many other properties are getting facelifts.

This year’s environmental accomplishments include a new foods scraps recycling center at Downing Park and approved solar projects IBM and Hemlock Hill Farm. The Town’s partnership with Sustainable Westchester has been so successful, Yorktown has the most participants in its community solar program than any other municipality in Westchester County, he said.

On Oct. 28, Latimer submitted a proposed 2022 budget for Westchester County that keeps county property taxes flat. This is the third budget in a row that Latimer has no increased property taxes. County property taxes have actually been cut slightly, by $7 Million in a budget of $2.2 Billion, a decrease of less than 1/2%, but it is a decrease, and the county tax levy has decreased overall in 2020, 2021 and now proposed in 2022.

Latimer said:“This is the largest tax cut in recent memory. I am proud of this budget and proud that through smart and innovative budgeting we have been able to cut taxes responsibly again, find new revenue sources, save and provide needed services to County residents. This is not rhetoric or lip service – this is results – this is good governing. We are committed to doing right by the people of Westchester County – and that is exactly what we have done.”

Latimer’s budget maintains all county services and includes increased funding for childcare subsidies, mental distress centers, healthcare clinics and small landlord assistance, which will provide funding for improvements in exchange for landlords agreeing to keep rents affordable.