By Dan Murphy

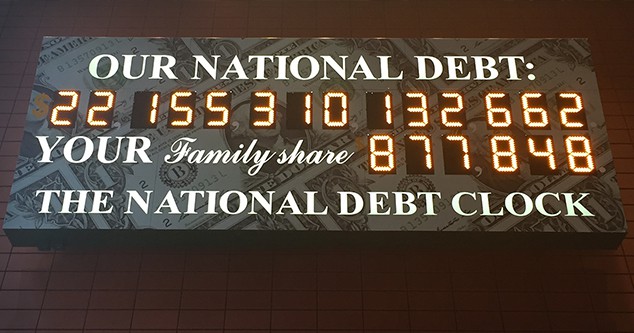

A recent meeting in Washington, D.C., between Senate Majority Leader Mitch McConnell and President Donald Trump had McConnell telling Trump that “no politician has ever lost an election for spending more money.” That comment came from one republican to another, which shows how far the political party of fiscal conservatism has slipped, as our country now has a budget debt of $22 trillion.

McConnell’s comments also show how hollow his previous public comments were when President Barack Obama was president, and McConnell and former Speaker Paul Ryan would rail against the Obama budgets and how he spent dollars that we had to borrow.

In 2011, Obama and then-Speaker of the House John Boehner had come to an agreement that would have significantly reduced budget deficits and debts for years to come. Called the Grand Bargain, democrats would have agreed to historic cuts in the federal government and the social safety net, and republicans would have agreed to increases in federal taxes.

The Grand Bargain never happened, because newly elected republican Tea Party members of Congress would not agree to tax increases, and democrats were opposed to spending cuts. Now, eight years later, the American people have a President who doesn’t care about spending, debts and deficits; a republican party that closes its eyes to more spending and a democratic party that supports a Green New Deal, Medicare for all and free college.

While there is no leader or party in Washington willing to stand up for fiscal prudence, and for not spending our children’s and grandchildren’s future, there are some Americans that do care, including young Americans who are starting to realize that the money we borrow today will have to be paid off tomorrow.

One group I am proud to say I’m a member of is the Peterson Foundation, founded by former Commerce Secretary Pete Peterson in 2008 to raise awareness of America’s long-term fiscal challenges and promote solutions to ensure a better economic future. As a non-partisan organization, the foundation works to put America on a fiscally sustainable path and protect the American Dream.

Pete Peterson died in 2018, but his son Michael Peterson continues the missioner of the foundation. After Congress and Trump passed the Bipartisan Budget Act of 2019, which is estimated to increase debt by $1.7 trillion over the next 10 years, Michael Peterson said it best about our current political climate in our nation’s capital: “This budget deal is Washington’s version of a compromise – everybody gets what they want, except the next generation.”

The current budget deficit is headed toward record territory, and for the first time, the Office of Management of Budget wrote in July, “The 2019 deficit has been revised to a projected $1 trillion.”

Peterson added: “This deal ignores our large and growing fiscal imbalances and is a step in the wrong direction for our economy. We’re already heading toward trillion-dollar annual deficits, so adding more to the debt is the last thing we need. There’s just no reason to be piling so much debt onto our kids and grandkids, especially during a strong economy, and when they will already face many daunting challenges like automation and climate change.”

Voters across party lines are increasingly concerned about the nation’s finances, according to the Peterson Foundation’s monthly Fiscal Confidence Index. More than four in five (83 percent) Americans want their leaders to spend more time addressing the national debt, including 85 percent of Democrats, 82 percent of Republicans and 81 percent of independents, and older Americans (56 percent) and younger Americans (57 percent) say we are on the wrong track to address the national debt.

In July, the Congressional Budget Office issued a report that reads:

“America remains on a treacherous fiscal path. This year’s report projects that debt nearly doubles relative to the size of the economy from 2019 to 2048, when it will be nearly 3.5 times greater than its average over the past 50 years. In America’s 243-year history, its highest level of debt was 106 percent of GDP (gross domestic product), which occurred as a direct result of U.S. involvement in WWII. We are currently projected to surpass that level in 2037.

“A larger debt also brings larger interest payments. Interest on the debt is projected to be three times greater in 30 years than it is today. The Central Budget Office anticipates that the U.S. will pay interest of more than 5.7 percent of GDP in 2049, up from the 1.8 percent that it will spend this year. By 2049, interest payments alone will comprise more than 20 percent of all federal spending, making it more difficult to fund national priorities and control the deficit in the future.

“In 2009, the Central Budget Office projected a debt of 56 percent of GDP for 2019; in actuality, the debt is now projected to be equal to 78 percent of GDP at the end of the 2019 fiscal year.”

An organization called Up to Us (itsuptous.org) has formed, giving college students and other young Americans the opportunity to speak out against continued rising debt and deficits. One letter on Up to Us, by Tia Falzarano reads:

“Americans are facing several issues blaming older generations for causing problems that range from climate changes because of pollution to social inequality. A major issue young Americans face is the national debt, which is growing by the second. One of the main reasons the national debt grows is because of programs like Social Security and Medicare. While these social safety nets are extremely beneficial to our grandparents, it is likely that it will not be available for millennials when we retire.

“As I mentioned, these programs will likely be gone by the time my generation retires. I wonder, if my grandma struggled to pay for needed medication with Medicare, what will happen to me? How will my generation pay for medical bills?

“Programs like Social Security and Medicare will disappear given the unsustainable rate our economy is heading. Unfortunately, I worry if these funds will ever be enough to support me when I want to retire.

“Over the last few decades, retirement age has increased. My grandparents were able to retire by the age of 55. While the current average retirement age ranges from 62 to 65, I doubt my parents will be able to retire in 10 years with this national debt. My parents have been hard workers all their life, and the national debt worries me, because my parents deserve to retire at a decent age.

“A tax hike and budget cuts are two ways to bring the national debt down for future generations. However, this adds to more problematic issues for all generations, especially millennials. The issues we face from these attempts are increasing unemployment rates and higher taxes. As broke college students that are burdened with thousands of dollars in student loans, we need jobs to afford a comfortable lifestyle.” (End of Falzarano letter.)

Central Budget Office Director Phil Swagel commented about the new debt and deficit projections, saying, “Higher interest costs are a major contributor to the large deficits that we project – that net outlays for interest would more than triple in relation to the size of the economy over the next three decades, exceeding all discretionary spending by 2046.

“Another significant contributor to the projected deficit is greater spending for Social Security and for major health care programs (primarily Medicare), reflecting both aging of the population and rising health care costs per person.

“The prospect of such large deficits over many years, and the high and rising debt that would result, poses substantial risks for the nation and presents policymakers with significant challenges,” said Swagel

Through Up to Us, the next generation is speaking out to be heard about how this issue affects them and what their generation can do to have a voice in raising awareness of our long-term fiscal and economic challenges. It’s not complicated: Whether you’re passionate about health care, higher education, clean energy technology or national defense, you have a vested interest in making sure we get our fiscal policy on a sustainable path.

Just like any family sitting around the table figuring out their monthly budget, the longer you wait to fix your overspending, the worse it gets. Acting sooner on the debt has significant benefits. On our current path, waiting just five years raises the cost of stabilization by 22 percent. Just like with the Grand Bargain, the sooner we act the stronger our fiscal future will be.

But right now, nobody in Washington wants to act responsibly. They all want to keep spending and borrowing because “nobody has lost an election by spending more.” Well, maybe it’s time to change Mr. McConnell’s thinking on that and change the narrative that “everyone gets what they want, except the next generation.”

Before we vote for Congress, or for U.S. Senate or president in 2020, take out a photo of your child, or grandchild, and think about their future. And, hopefully, with the help of the Peterson Foundation, we can elect responsible members of Congress, and a president who is willing to do maybe the unpopular, but responsible decision.